texas estate tax law

No single property or type of property should pay more than its fair share. This law will drastically alter how property taxes are calculated in Texas and its.

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Finally the new Texas property tax law is the most significant change coming in 2022.

. The Pratt Law Group has decades of experience helping businesses big and small understand the complexities. Additionally states levy extra taxes on items such as liquor tobacco products and gasoline. This set provides coverage of every aspect of probate law and estate and trust administration in Texas.

A Closer Look The Matter of Texas Probate Taxes. Increased oversight and public involvement in tax increases ensures that property taxes will grow at a. Politicians have promised to cut property taxes but many believe they have failed to deliver.

Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services. Property tax brings in the most money of all taxes available to local governments to pay for schools roads police and firemen emergency response services. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

In short the tax reform law is good news for anyone who owners property in Texas. Texas estate planning electronic resource With fingertip access. Relationships between landlords and tenants.

Property and real estate law includes homestead protection from creditors. The Texas Constitution sets out five basic rules for property taxes in our state. The following rules were filed with the Secretary of State for adoption on Oct.

We counsel individuals and companies on every aspect of Texas tax laws. There is no state property tax. State revenues are comprised of property taxes sales tax and certain taxes on businesses.

It includes sample forms and letters procedural checklists lists of. Under Texas law the taxation of property must be uniform and equal meaning that no single property should pay. Theres more good news.

Published in the Texas Administrative Code Oct. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the. Texas has no state property tax.

The Estate Tax is a tax on your right to transfer property at your death. The Comptrollers office does not collect property tax or set tax rates. Here are some basic rules for property taxes in Texas.

Taxation must be equal and uniform. And other matters pertaining to ones home or residence. It includes information on tracking estate planning documents final arrangements real estate and tax records.

Lasting reform and a fix to the property tax issues were the assured results of the. And became effective on Oct. There is no state property tax.

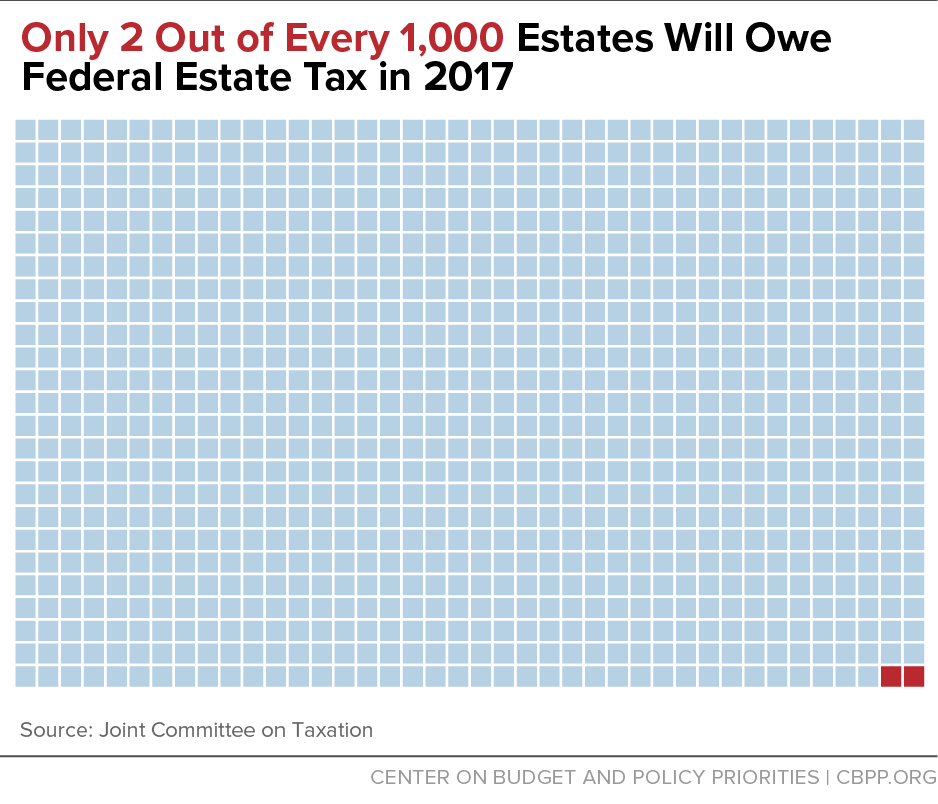

Thats up to local taxing units which use tax revenue to. Most Americans will never have to pay a dime in estate tax because the federal government exempts all estates worth less than roughly 12 million.

Frank Law Firm Llp Probate Attorney Houston Estate Lawyer

Estate Planning Lawyer Probate Attorney Legal Wills Living Trust Plano Dallas Collin County Texas

Transfer On Death Tax Implications Findlaw

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Texas Estate Tax Everything You Need To Know Massingill

Op Ed Proposed Estate Tax Law Changes Hit Farms Hard El Paso Herald Post

Texas Tax Attorneys Pratt Law Group Estate Planning Probate Business Law Bankruptcy

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Is There An Inheritance Tax In Texas

Estate And Inheritance Taxes Urban Institute

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

Texas Living Will Form Free Download Cocosign

Does Your State Have An Estate Or Inheritance Tax

Texas Estate Tax Everything You Need To Know Smartasset

More Than Half Of America S 100 Richest People Exploit Special Trusts To Avoid Estate Taxes Propublica